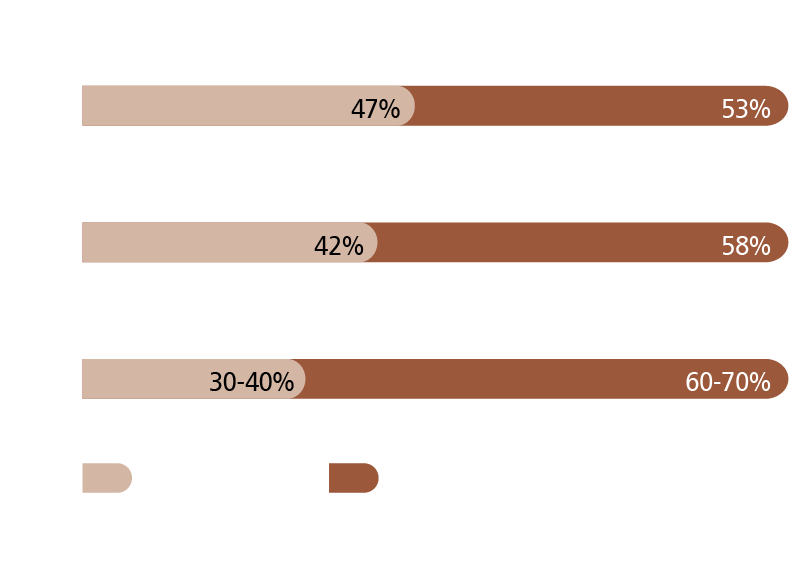

For TSMC, today around ~70% of our total revenue is 16nm and more advanced nodes. With rising contribution from 3nm and 2nm technologies in the next several years, this number will only increase. Thus, our mature node exposure is around ~20% of our total revenue.

Our focus on mature nodes is to build high yield capacity for specialized technologies, rather than just nominal capacity. In 2023, we worked closely with our customers to introduce specialty technologies such as N6RF+ for smartphones, CMOS Image Sensors for cameras, and 22nm MRAM for automotive and industrial applications. Our mature node strategies will continue to focus on working closely with strategic customers to develop specialty technology solutions to meet their requirement, and create differentiated and long-lasting value to customers.

In 2023, we inaugurated our new R&D center in Taiwan, and further enhanced our R&D intensity and technology development. Our industry-leading 3-nanometer technology entered high volume production with a strong ramp in the second half of 2023. We are also providing continuous enhancements of our N3 technology, including N3E, N3P and N3X, and expect an even greater contribution in 2024 and the years beyond, supported by robust demand from multiple customers.

Our 2-nanometer is on track for volume production in 2025. It will be the most advanced technology in the semiconductor industry in both density and energy efficiency, when it is introduced. N2 will adopt nanosheet transistor structure, and deliver full-node performance and power benefits, to address the increasing need for energy-efficient computing. As part of N2 technology platform, we also developed N2 with backside power rail solution, which is better-suited for specific HPC applications, to be available in the second half of 2025 to customers, with production in 2026.

We are observing a strong level of customer interest and engagement at our N2, higher than N3 at a similar stage, from both HPC and smartphone applications. With our strategy of continuous enhancements, N2 and its derivatives will further extend our technology leadership well into the future.

The insatiable demand for energy-efficient computing power not only requires leading edge process technologies, but also advanced packaging technologies to enable large-scale interconnectivity for lower power consumption, at affordable costs. TSMC’s industry-leading 3DFabric® backend technologies include the CoWoS® and InFO family of advanced packaging technologies, with CoWoS® technology seeing robust demand from multiple customers’ AI chips in 2023. Our frontend 3DIC technologies, TSMC-SoIC® (System on Integrated Chips), also entered mass production in 2023 to enable customers’ next generation flagship AI products.

We are working closely with our customers in a disciplined manner to plan our capacity, based on the long-term market demand profile, and investing in leading edge and specialty technologies, to support their structural growth.

Part of this strategy is to expand our global manufacturing footprint to increase customer trust, expand our future growth potential, and reach for more global talents. Our overseas decisions are based on our customers’ needs, and a necessary level of government support. This is to maximize the value for our shareholders.

In the U.S., we are making good progress on our first fab in Arizona in terms of the fab infrastructure, utilities and equipment installation. We are on track for volume production of N4 technology in the first half of 2025, with the same level of manufacturing quality and reliability in Arizona as from our fabs in Taiwan.

We are also building a 12-inch specialty technology fab in Kumamoto, Japan, which is on track for volume production in the fourth quarter of 2024. We also announced plans to build an automotive and industrial specialty fab in Dresden, Germany, with construction starting in the fourth quarter of 2024.

While the initial costs of overseas fabs are higher than TSMC’s fabs in Taiwan, we are confident to manage and minimize the cost gap, so that we can continue to maximize the value for our shareholders.

We are also placing a strong focus on our digital excellence initiatives, which includes leveraging big data and AI to increase our fab productivity and operational efficiency and quality. By driving digital excellence at TSMC, our fabs are transforming to become engineer-centric rather than operator-centric. As we expand globally, we will continuously enhance the intelligence of our fabs, so that we can control and manage fab operations from anywhere in the world, and deepen our service to support our customers.

Highlights of TSMC’s accomplishments in 2023:

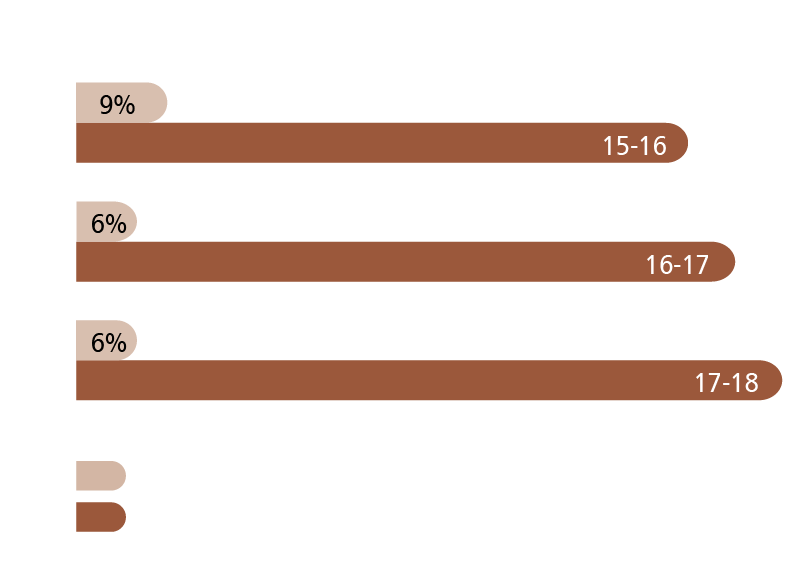

- Total wafer shipments were 12.0 million 12-inch equivalent wafers as compared to 15.3 million 12-inch equivalent wafers in 2022.

- Advanced technologies (7-nanometer and beyond) accounted for 58 percent of total wafer revenue, up from 53 percent in 2022.

- We deployed 288 distinct process technologies, and manufactured 11,895 products for 528 customers.

- TSMC produced 28 percent of the world semiconductor excluding memory output value in 2023, as compared to 30 percent in the previous year, mainly due to the semiconductor industry inventory correction.

2023 Financial Performance

Consolidated revenue reached NT$2,161.74 billion, a decrease of 4.5 percent over NT$2,263.89 billion in 2022. Net income was NT$838.50 billion and diluted earnings per share were NT$32.34. Both decreased 17.5 percent from the 2022 level of NT$1,016.53 billion net income and NT$39.20 diluted EPS.

TSMC generated net income of US$26.88 billion on consolidated revenue of US$69.30 billion, which decreased 21.1 percent and 8.7 percent respectively from the 2022 level of US$34.07 billion net income and US$75.88 billion consolidated revenue.

Gross profit margin was 54.4 percent as compared with 59.6 percent in 2022, while operating profit margin was 42.6 percent compared with 49.5 percent a year earlier. Net profit margin was 38.8 percent, a decrease of 6.1 percentage points from 2022’s 44.9 percent.

In 2023, the Company further raised its total cash dividend payments to NT$11.25 per share, up from NT$11.0 a year ago.

Environmental, Social and Governance

In addition to driving profitable growth in our core business, TSMC continues to cultivate green manufacturing, build a responsible supply chain, create an inclusive workplace, attract and develop talent, and care for the underprivileged, fulfilling the Company’s responsibilities as a corporate citizen.

Maintaining the highest standard of corporate governance is an essential part of our core values. In February 2023, TSMC’s Board of Directors approved the establishment of the “Nominating, Corporate Governance and Sustainability Committee.” The Committee is actively involved in developing TSMC’s sustainability strategies, to lay the foundation for our future sustainable development. In addition, the Committee focuses on reviewing and improving TSMC’s corporate governance structure, including recommending independent director candidates to the Board.

In 2023, we also announced an acceleration of our RE100 sustainability timetable, pulling forward our target for 100% renewable energy consumption for all global operations from 2050 to 2040. We also raised our 2030 target for company-wide renewable energy consumption from 40% to 60%, demonstrating our determination to achieve our environmental sustainability goals at a faster pace.

Corporate Developments

In August 2023, TSMC announced its plan to invest in European Semiconductor Manufacturing Company (ESMC) GmbH, in Dresden, Germany, along with Robert Bosch GmbH, Infineon Technologies AG, and NXP Semiconductors N.V., to build a specialty technology fab focusing on automotive and industrial applications. ESMC is expected to have a monthly capacity of 40,000 wafers on TSMC’s 28/22 nanometer planar CMOS and 16/12 nanometer FinFET process technology.

In December 2023, TSMC announced that Dr. Mark Liu plans to retire from TSMC in June 2024, and will not seek re-election to the board of directors. During his tenure, Dr. Liu has reaffirmed the Company’s commitment to its mission and focused on enhancing corporate governance and competitiveness particularly in technology leadership, digital excellence, and global footprint. TSMC’s Nominating, Corporate Governance and Sustainability Committee recommends Dr. C.C. Wei, while remaining as CEO, to succeed as TSMC’s next Chairman, subject to the election of the incoming board in June 2024.

Honors and Awards

TSMC received recognition for achievements in innovation, corporate governance, sustainability, investor relations and overall excellence in management from organizations including Forbes, Fortune Magazine, CommonWealth Magazine, Taiwan Stock Exchange, and Taiwan Institute for Sustainable Energy. For innovation, TSMC was recognized as 3rd in IFI Claims Patent Services’ “2023 Top 50 U.S. Patent Assignees.” TSMC was also recognized by Fortune Magazine as “2023 World’s Most Admired Companies.” In sustainability, we were chosen once again as a component of the Dow Jones Sustainability Indices, becoming the only semiconductor company to be selected for 23 consecutive years. We also received MSCI ESG Research’s AAA Rating, CDP’s “2022 CDP Supplier Engagement Leader,” Morningstar’s “The Best Sustainable Companies to Own in 2024,” S&P Global’s Corporate Sustainability Assessment – Top 10% S&P Global ESG Score, ISS-oekom Corporate Rating’s “Prime” status, Financial Times and Statista’s “Asia-Pacific Climate Leaders 2023,” and Forbes’ “World’s Best Employers 2023.” Meanwhile, we remained a major component in various MSCI ESG and FTSE4Good indices. In investor relations, TSMC continued to receive multiple awards from Institutional Investor Magazine.

Outlook

Entering 2024, macroeconomic weakness and geopolitical uncertainties persist, potentially further weighing on consumer sentiment and end market demand. Against that backdrop, our business is expected to be supported by the continued strong ramp of our industry-leading 3nm technologies and robust AI-related demand, and we expect 2024 to be a healthy growth year for TSMC.

Recent developments, such as growing national security concerns, the reshaping of global supply chains, and the intensifying competition in the quest for AI supremacy, have deepened geopolitical uncertainties.

At the same time, as AI technology evolves to use more complex AI models, the amount of computation required for training and inference continues to increase. As a result, AI models need to be supported by more powerful semiconductor hardware, which use the most advanced semiconductor process technologies.

TSMC’s success is predicated on providing the industry’s most leading edge process technologies at scale, in the most efficient and cost-effective manner, to enable innovators to successfully offer the best products to the world.

As we become a technology leader in the semiconductor industry, we are shouldering a greater responsibility of R&D and investment in the industry. With our strong technology leadership in leading edge process technologies and advanced packaging solutions, we are able to capture a greater portion of the industry’s growth opportunities.

We focus on the fundamentals of our business, and will execute our global manufacturing footprint strategy purposefully, to support our customers’ growth and increase their trust. We will continue to drive digital excellence across all our fabs globally and work towards fully intelligent and automated manufacturing. We are determined to be the most efficient and cost-effective manufacturer, no matter where we operate.

As the world grows more complex, semiconductor technology is the foundational technology for the modern digital economy. The semiconductor value in the global supply chain continues to increase, providing greater value for our customers, and greater value opportunities for TSMC.

We do not take our role and responsibility in the global semiconductor industry lightly. We will not deviate from our pure-play foundry business model, which has demonstrated time and again to be a win-win model for TSMC and our customers. We will continue to uphold our Trinity of Strengths of Technology Leadership, Manufacturing Excellence, and Customer Trust, to enable our customers to unleash their innovations in their end markets.

We will hold ourselves to the highest standards of corporate governance, and will adhere to our core values of Integrity, Commitment, Innovation and Customer Trust, no matter where we operate, while pursuing a sustainable future. We deeply value your trust in TSMC through the challenges of 2023. We are very excited about our future, and will work hard to run our business well, deliver good results and continue to maximize the value for our shareholders in the years to come.

C.C. Wei

Chief Executive Officer