Page 254 - TSMC 2022 Annual Report

P. 254

Valuation techniques and assumptions used in Level 2 fair value measurement

The fair values of financial assets and financial liabilities are determined as follows:

The fair values of corporate bonds, agency bonds, agency mortgage-backed securities, asset-backed securities and government bonds are determined by quoted market prices provided by third party pricing services.

The fair values of forward contracts are measured using forward rates and discount rates derived from quoted market prices.

The fair value of accounts receivable classified as at FVTOCI is determined by the present value of future cash flows based on the discount rate that reflects the credit risk of counterparties

Valuation techniques and assumptions used in Level 3 fair value measurement

The fair values of non-publicly traded equity investments (excluding those trading on the Emerging Stock Board) are mainly determined by using the asset approach and market approach.

The asset approach takes into account the net asset value measured at the fair value by independent parties. On December 31, 2022 and 2021, the Company uses unobservable inputs derived from discount for lack of marketability of 10%. When other inputs remain equal, the fair value will decrease by NT$48,704 thousand and NT51,372 thousand, respectively, if discounts for lack of marketability increase by 1%.

For the remaining few investments, the market approach is used to arrive at their fair values, for which the recent financing activities of investees, the market transaction prices of the similar companies and market conditions are considered.

In addition, the fair values of convertible bonds are prior transaction prices.

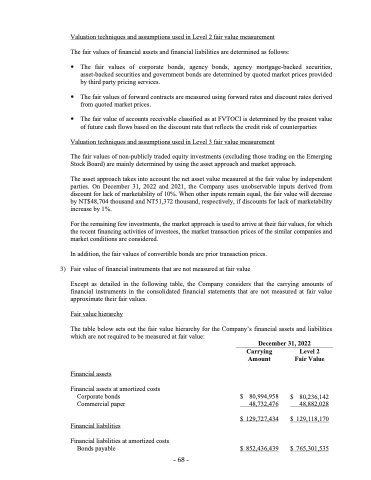

3) Fair value of financial instruments that are not measured at fair value

Except as detailed in the following table, the Company considers that the carrying amounts of financial instruments in the consolidated financial statements that are not measured at fair value approximate their fair values.

Fair value hierarchy

The table below sets out the fair value hierarchy for the Company’s financial assets and liabilities

which are not required to be measured at fair value:

Financial assets

Financial assets at amortized costs Corporate bonds

Commercial paper

Financial liabilities

Financial liabilities at amortized costs Bonds payable

December 31, 2022

Carrying Amount

$ 80,994,958 48,732,476

$ 129,727,434 $ 852,436,439

Level 2 Fair Value

$

$ 129,118,170

80,236,142 48,882,028

$ 765,301,535

- 68 -

- 68 -