Annual Reports >

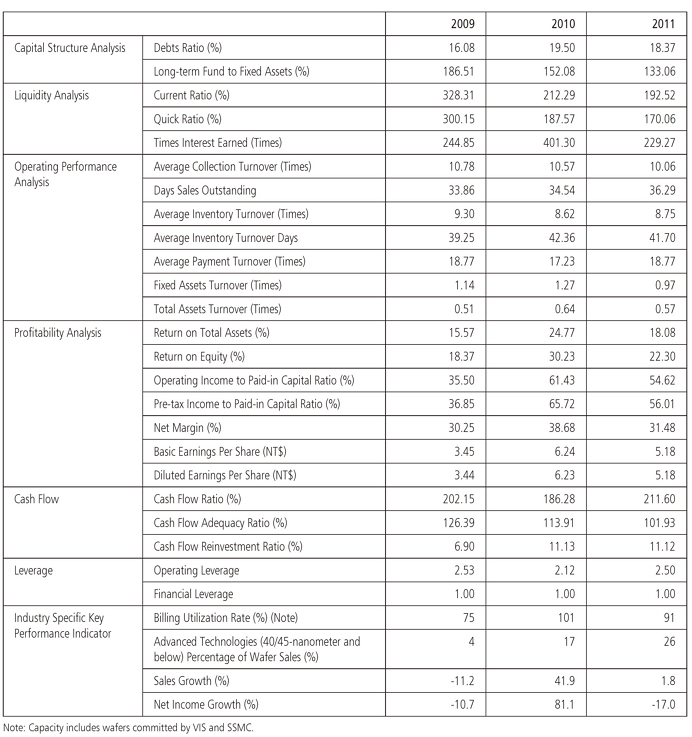

2013 > Financial Information > Financial Analysis > 2009 to 2011 (Consolidated) - ROC GAAP

Financial Analysis

openmenu

- Financial Analysis from 2012 to 2013 (Consolidated)

- Financial Analysis from 2009 to 2011 (Consolidated) - ROC GAAP

- Financial Analysis from 2012 to 2013 (Unconsolidated)

- Financial Analysis from 2009 to 2011 (Unconsolidated) - ROC GAAP

*Glossary

| 1. | Capital Structure Analysis | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|||||||||||||||

| 2. | Liquidity Analysis | ||||||||||||||

|

|||||||||||||||

| 3. | Operating Performance Analysis | ||||||||||||||

|

|||||||||||||||

| 4. | Profitability Analysis | ||||||||||||||

|

|||||||||||||||

| 5. | Cash Flow | ||||||||||||||

|

|||||||||||||||

| 6. | Leverage | ||||||||||||||

|