Page 348 - TSMC 2022 Annual Report

P. 348

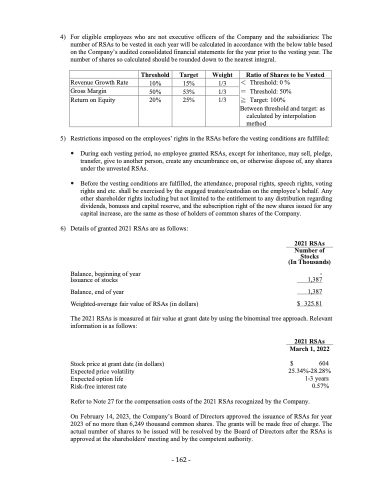

4) For eligible employees who are not executive officers of the Company and the subsidiaries: The number of RSAs to be vested in each year will be calculated in accordance with the below table based on the Company’s audited consolidated financial statements for the year prior to the vesting year. The number of shares so calculated should be rounded down to the nearest integral.

Revenue Growth Rate Gross Margin

Threshold Target Weight

10% 15% 1/3 50% 53% 1/3

Ratio of Shares to be Vested

< Threshold: 0 % = Threshold: 50% ≧ Target: 100%

Between threshold and target: as calculated by interpolation method

Return on Equity

20%

25%

1/3

5) Restrictions imposed on the employees’ rights in the RSAs before the vesting conditions are fulfilled:

During each vesting period, no employee granted RSAs, except for inheritance, may sell, pledge, transfer, give to another person, create any encumbrance on, or otherwise dispose of, any shares under the unvested RSAs.

Before the vesting conditions are fulfilled, the attendance, proposal rights, speech rights, voting rights and etc. shall be exercised by the engaged trustee/custodian on the employee’s behalf. Any other shareholder rights including but not limited to the entitlement to any distribution regarding dividends, bonuses and capital reserve, and the subscription right of the new shares issued for any capital increase, are the same as those of holders of common shares of the Company.

6) Details of granted 2021 RSAs are as follows:

Balance, beginning of year Issuance of stocks

Balance, end of year

Weighted-average fair value of RSAs (in dollars)

2021 RSAs Number of

Stocks

(In Thousands)

$

- 1,387

1,387 325.81

The 2021 RSAs is measured at fair value at grant date by using the binominal tree approach. Relevant information is as follows:

Stock price at grant date (in dollars) Expected price volatility

Expected option life

Risk-free interest rate

2021 RSAs March 1, 2022

$ 604 25.34%-28.28%

1-3 years 0.57%

Refer to Note 27 for the compensation costs of the 2021 RSAs recognized by the Company.

On February 14, 2023, the Company’s Board of Directors approved the issuance of RSAs for year

2023 of no more than 6,249 thousand common shares. The grants will be made free of charge. The actual number of shares to be issued will be resolved by the Board of Directors after the RSAs is approved at the shareholders' meeting and by the competent authority.

- 162 -

- 162 -