Page 322 - TSMC 2022 Annual Report

P. 322

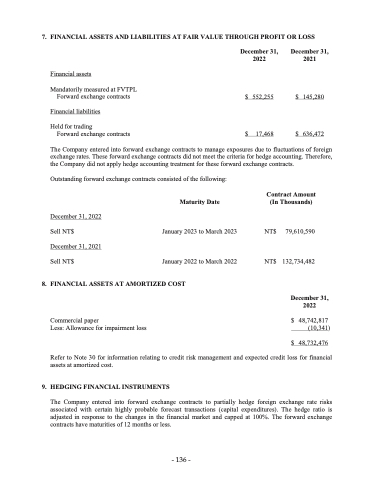

7. FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE THROUGH PROFIT OR LOSS

Financial assets

Mandatorily measured at FVTPL Forward exchange contracts

Financial liabilities

Held for trading

Forward exchange contracts

December 31, 2022

$ 552,255

$ 17,468

December 31, 2021

$ 145,280

$ 636,472

The Company entered into forward exchange contracts to manage exposures due to fluctuations of foreign exchange rates. These forward exchange contracts did not meet the criteria for hedge accounting. Therefore, the Company did not apply hedge accounting treatment for these forward exchange contracts.

Outstanding forward exchange contracts consisted of the following:

December 31, 2022 Sell NT$ December 31, 2021 Sell NT$

Maturity Date

January 2023 to March 2023 January 2022 to March 2022

Contract Amount (In Thousands)

NT$ 79,610,590 NT$ 132,734,482

December 31, 2022

$ 48,742,817 (10,341)

$ 48,732,476

8. FINANCIAL ASSETS AT AMORTIZED COST

Commercial paper

Less: Allowance for impairment loss

Refer to Note 30 for information relating to credit risk management and expected credit loss for financial assets at amortized cost.

9. HEDGINGFINANCIALINSTRUMENTS

The Company entered into forward exchange contracts to partially hedge foreign exchange rate risks associated with certain highly probable forecast transactions (capital expenditures). The hedge ratio is adjusted in response to the changes in the financial market and capped at 100%. The forward exchange contracts have maturities of 12 months or less.

- 136 -

- 136 -