Page 216 - TSMC 2022 Annual Report

P. 216

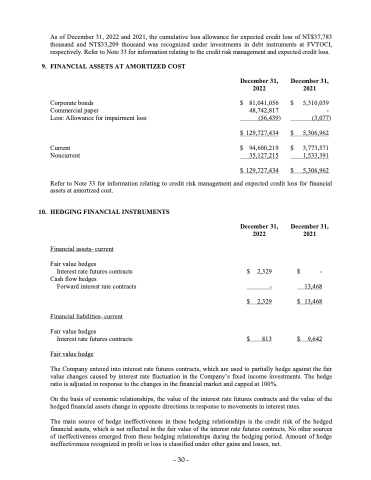

As of December 31, 2022 and 2021, the cumulative loss allowance for expected credit loss of NT$37,783 thousand and NT$33,209 thousand was recognized under investments in debt instruments at FVTOCI, respectively. Refer to Note 33 for information relating to the credit risk management and expected credit loss.

9. FINANCIAL ASSETS AT AMORTIZED COST

Corporate bonds

Commercial paper

Less: Allowance for impairment loss

December 31,

December 31,

2022 2021

$

$

$ 5,310,039 (3,077)

$ 5,306,962

$ 3,773,571 1,533,391

129,727,434

expected credit loss for financial

Current $ Noncurrent

$

Refer to Note 33 for information relating to credit risk management and assets at amortized cost.

10. HEDGINGFINANCIALINSTRUMENTS

Financial assets- current

Fair value hedges

Interest rate futures contracts

Cash flow hedges

Forward interest rate contracts

Financial liabilities- current

Fair value hedges

Interest rate futures contracts

Fair value hedge

(56,439)

129,727,434

94,600,219 35,127,215

81,041,056

48,742,817 -

$ 5,306,962

December 31, 2022

$ 2,329 - $ 2,329

$ 813

December 31, 2021

$

$ 13,468

- 13,468

$ 9,642

The Company entered into interest rate futures contracts, which are used to partially hedge against the fair

value changes caused by interest rate fluctuation in the Company’s fixed income investments. The hedge

ratio is adjusted in response to the changes in the financial market and capped at 100%.

On the basis of economic relationships, the value of the interest rate futures contracts and the value of the hedged financial assets change in opposite directions in response to movements in interest rates.

The main source of hedge ineffectiveness in these hedging relationships is the credit risk of the hedged financial assets, which is not reflected in the fair value of the interest rate futures contracts. No other sources of ineffectiveness emerged from these hedging relationships during the hedging period. Amount of hedge ineffectiveness recognized in profit or loss is classified under other gains and losses, net.

- 30 -

- 30 -